Tenants In Common with a Protective Property Trust

A PPT has to be created whilst both owners are alive.

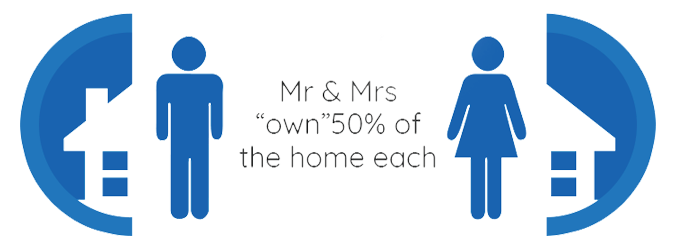

The joint tenancy of the property is severed, meaning that Mr and Mrs Brown will then own 50% of the property each, known as ‘Tenants in Common’.

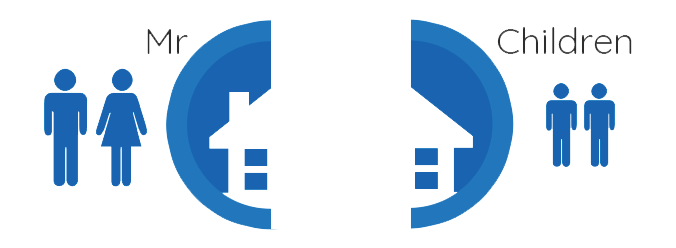

They make Protective Property Trust Wills, leaving their 50% share to the trust for their children on first death.

Mrs Brown sadly passes away meaning her share goes into a trust for her children.

The trust allows Mr Brown to live in the house for the rest of his natural life. Should Mr Brown wish to move in the future, he can use all of the money from the sale of the house to buy another, if Mrs Brown allowed this in her Will. The children cannot charge Mr Brown rent nor force him to the house.

Reasons to have a Protective Property Trust

Protective Property Trust (PPT) can help you protect your home and ensure that it is passed on to the people you care about.

New Marriage

If Mr Brown remarried the children will never be disinherited as their money is secured in a trust.

Care Home Fees

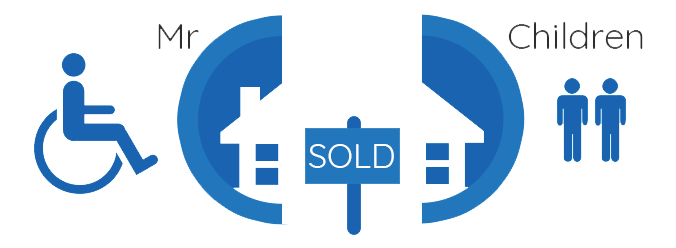

Mr Brown goes into Care and if no other assets are available to fund Care costs the Local Authority can request sale of the property but can only use 50% of the sale.

Beneficial Joint Owners – How It Works

On first death, your home will default to the survivor. This could mean that your property could potentially be used to fund care home fees or could cause second marriage disinheritance.

Here’s an example:

Mr and Mrs Brown are joint owners on their property.

Mrs Brown sadly passes away meaning Mr Brown inherits the whole house.

This creates two common ways of your asset not being inherited from your chosen beneficiaries.

Remarriage

If Mr Brown remarried he could leave all

his estate to the new spouse.

Care Home Fees

Mr Brown goes into Care and if no other assets are available to fund Care costs the Local Authority can request sale of the property.

Protective Property Trust (PPT) can help you protect your home and ensure that it is passed on to the people you care about.

Telephone Appointment

Call us today on 01604 807359

Make A Will Online

Coming soon!

Face-To-Face Meeting

Golden Words From Our Clients

Are You Looking For Someone To Help? Contact Us Today.

Home visits and evening appointments are available on request.